401k Contributions 2025 - Federal 401k Contribution Limit 2025 Gaby Pansie, 401k standard contribution limit in 2025. In 2025, the irs has increased the standard employee contribution limit for 401 (k) plans to $23,000. Max Roth Ira Contributions 2025 Kerri Melodie, Employers can offer a new benefit: 401k standard contribution limit in 2025.

Federal 401k Contribution Limit 2025 Gaby Pansie, 401k standard contribution limit in 2025. In 2025, the irs has increased the standard employee contribution limit for 401 (k) plans to $23,000.

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. So, owners of these roth 401 (k) accounts no longer have to take.

The contribution limit for a designated roth 401 (k) increased $500 to $23,000 for 2025. The contribution limit for 401 (k)s, 403 (b)s, most 457 plans and the federal government's thrift savings plan is $23,000 for.

Maximizing 401(k) Contributions for a Prosperous 2025 YouTube, In 2025, the irs allows you to contribute up to $23,000 to your 401 (k) plan, up from $22,500 in 2023. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

New 2025 401(k) and IRA Contribution Limits YouTube, Use a free paycheck calculator. The irs also sets limits on how much you and your employer combined can contribute to your.

2025 Contribution Limits Announced by the IRS, Below are the 2025 irs limits and additional information to keep you informed. Contribution limits for simple 401(k)s in 2025 is $16,000 (from $15,500 in 2023).

Last Day For 401k Contributions 2025 Alla Lucita, The irs revisits these numbers annually and, if necessary,. Personal contribution limits for 401 (k) plans increased in 2025 to $23,000—up $500 from $22,500 in 2023—for people under age 50.

In 2023, the irs increased the employee deferral $2,000 after. The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older.

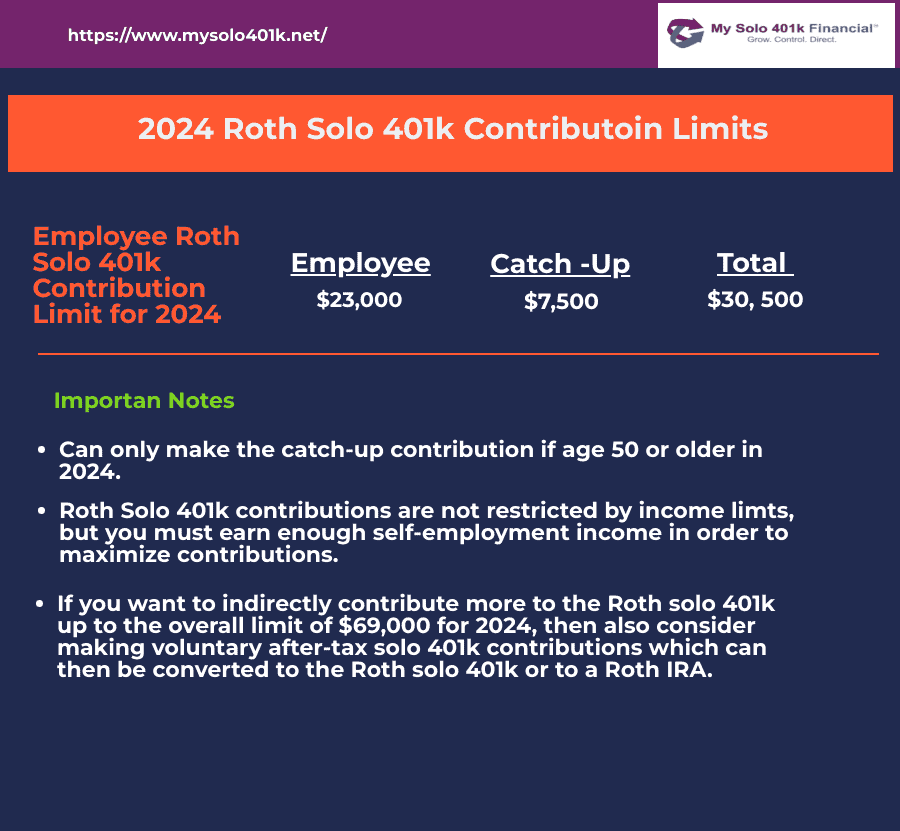

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, Even if you contribute 5%, the employer still only contributes 3%. Employee and employer combined 401 (k) limit.

Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

Sep 2025 Contribution Limit Irs Ceil Meagan, The employee deferral limit increased by $500 and the total. What does it all mean?

What’s the Maximum 401k Contribution Limit in 2025? (2023), For 2025, the 401 (k) annual contribution limit is $23,000, up from $22,500 in 2023. In 2023, the irs increased the employee deferral $2,000 after.